Comprehensive strategies in a simple package

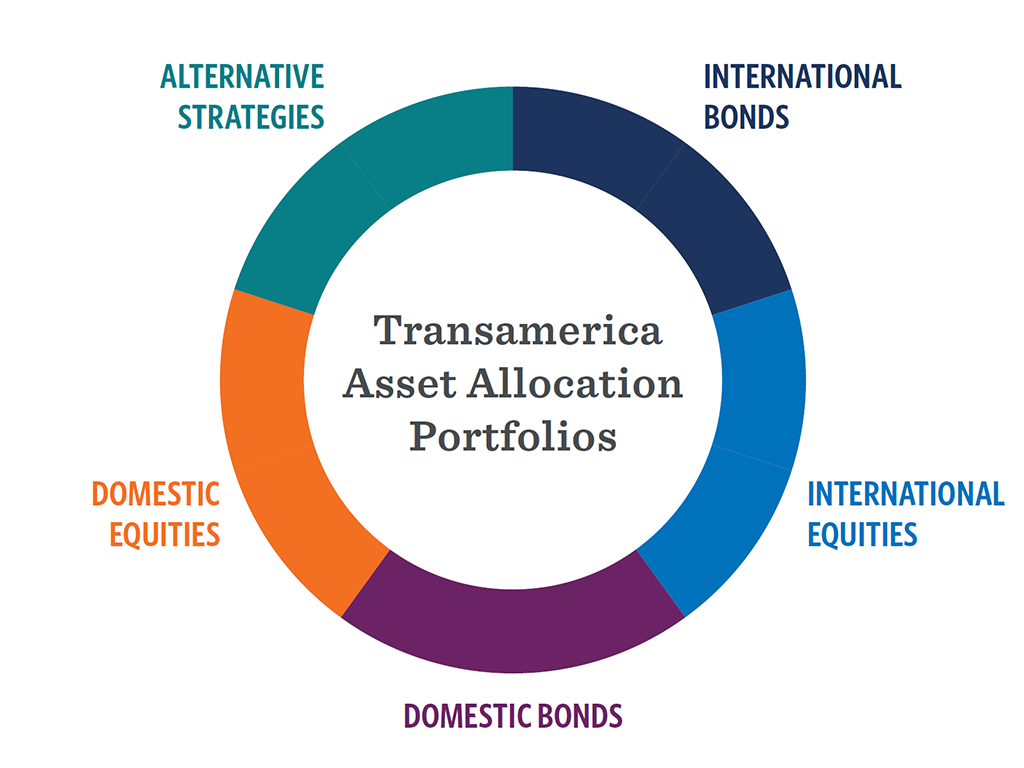

Transamerica Asset Allocation Portfolios

Potential to enhance returns, reduce volatility, and feel good about your clients’ financial future.

- A simplified, easy-to-understand investment solution for clients

- Broad diversification with one investment

- Active portfolio management from 20+ leading investment managers

- A rigorous portfolio management process by Goldman Sachs Asset Management, L.P.

- Ongoing portfolio rebalancing to maintain asset allocation targets

The power to choose

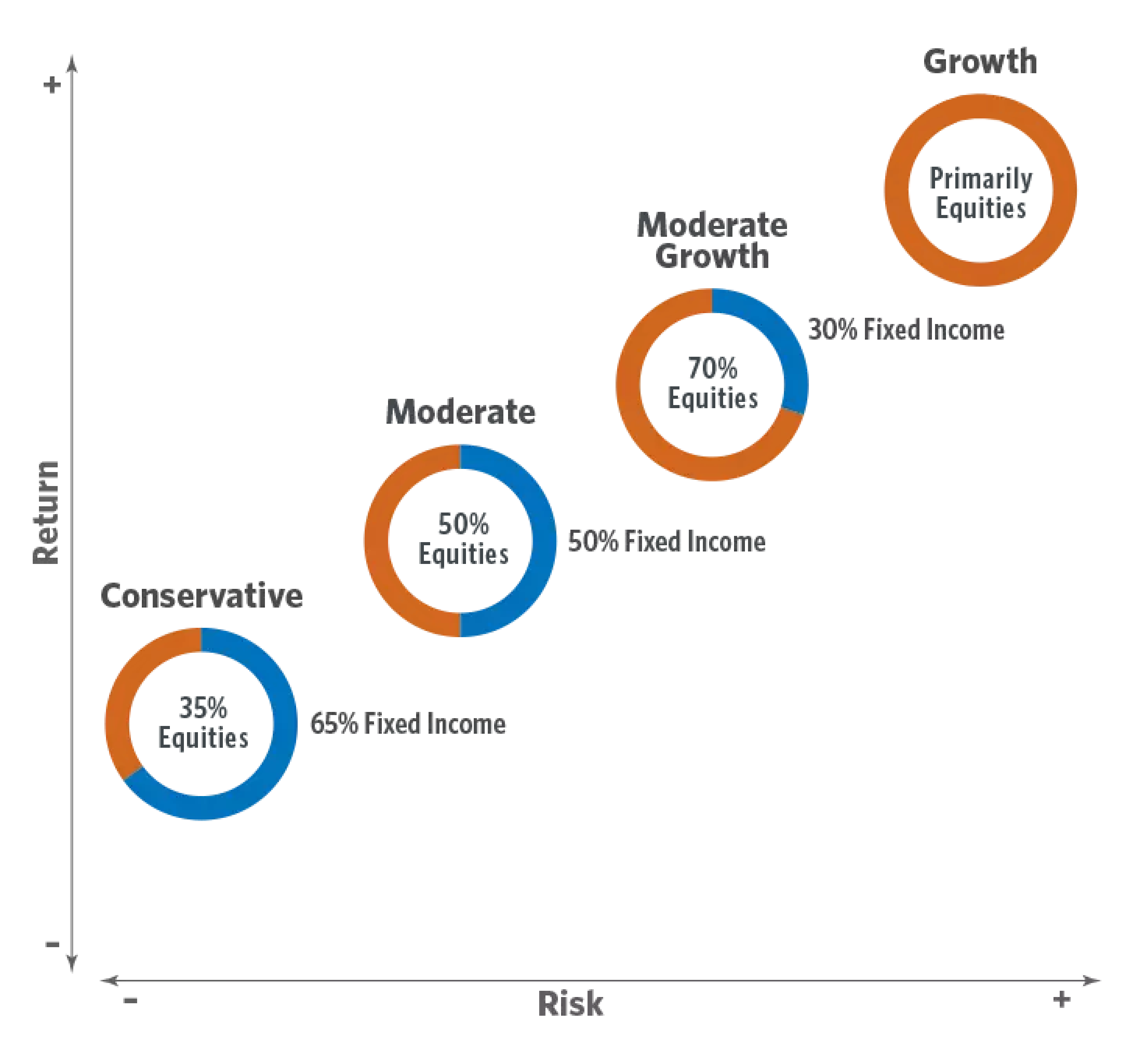

It's important to choose a portfolio that best suits an individual's goals, risk tolerance, and time horizon. The Transamerica Asset Allocation Portfolios are actively managed, ranging in risk tolerance from conservative to growth. They are designed to seek maximum returns while maintaining a level of risk that's comfortable for the investor.

Sample proposals

A quick, easy-to-read summary of each portfolio's holdings, allocations, and performance history.

Holdings and performance

Finding the perfect fit

There are many ways the Transamerica Asset Allocation Portfolios can fit into an investment plan.

A core portfolio holding

Adding a core holding with automatic rebalancing can help keep a portfolio true to its intended allocation. Consider using a Transamerica Asset Allocation Portfolio as a core holding with more specialized strategies as a complement.

A diversified portfolio

Asset allocation and diversification are designed to smooth market volatility, help you reach your investment goals, and help you avoid succumbing to short-term emotional investing.

A complement to “go anywhere” funds

Strategies that have the ability to move to all cash may be able to protect assets in a downturn but could also miss opportunities when markets rebound. A Transamerica Asset Allocation Portfolio, with its ability to shift assets, is designed to keep the investor's money working for them.

Get in touch

Fill out the form below and a wholesaler will reach out to you.

Market commentary & insights

Read the latest opinions, insights, and thought leadership from Transamerica Asset Management, Inc., Chief Investment Officer Tom Wald, CFA®

Important information

Mutual funds are subject to market risk, including the loss of principal. Past performance is not indicative of future results.

Mutual funds are sold by prospectus. Before investing, consider the funds' investment objectives, risks, charges, and expenses. This and other important information is contained in the prospectus. Please click here, or contact your financial professional to obtain a prospectus or, if available, a summary prospectus containing this information. Please read it carefully before investing

Asset allocation and diversification do not assure or guarantee better performance, cannot eliminate the risk of investment losses, and do not protect against an overall declining market. Fees associated with a fund-of-funds may be higher than with other funds. An investment in the fund is subject to the risks associated with the underlying funds including fixed income investing. Fixed-income securities are subject to risks including credit risk, interest rate risk, counterparty risk, prepayment risk, extension risk, valuation risk, and liquidity risk. Investments in small- and medium-sized companies present additional risks such as increased volatility because their earnings are less predictable, their share price more volatile, and their securities less liquid than larger or more established companies. Investing internationally, globally, or in emerging markets exposes investors to additional risks and expenses such as changes in currency rates, foreign taxation, differences in auditing, and other financial standards not associated with investing domestically.

Transamerica Funds are advised by Transamerica Asset Management, Inc. (TAM) and distributed by Transamerica Capital, LLC. member of FINRA. Transamerica companies and Goldman Sachs Asset Management, L.P., are not affiliated companies. 1801 California St., Suite 5200, Denver, CO 80202.